IRRD Consultation and Draft Taxonomy: What you need to know, and how to get ready

• By Ben Joyce FIA

EIOPA has launched its long-awaited consultation on the draft reporting framework for the Insurance Recovery and Resolution Directive (IRRD). This marks a key milestone in the development of the EU’s approach to ensuring orderly recovery and resolution for insurers, and with it comes a first look at the proposed technical reporting requirements, including a draft XBRL taxonomy.

The first reporting date is still some way off (likely some time in 2027), but with the consultation now live, it’s a good opportunity for firms to start assessing what’s involved and how they’ll meet the new obligations.

What is the Insurance Recovery and Resolution Directive (IRRD)?

The Insurance Recovery and Resolution Directive (IRRD) is a new piece of EU legislation designed to ensure that insurers are better prepared for financial distress, and that authorities have the tools they need to manage a resolution in an orderly fashion. IRRD establishes tools and mechanisms designed to reduce the likelihood of an insurance failure and mitigate the impact in case it finally happens, and to encourage coordination and cooperation among authorities.

The directive introduces requirements for insurance recovery and resolution planning, including:

- Pre-emptive Recovery Plans drafted by insurers themselves

- Resolution Plans developed by resolution authorities

- A set of resolution powers and safeguards aligned with international standards

In many ways, it’s the Solvency II equivalent of the banking world’s BRRD.

Until now, there’s been little concrete detail on how supervisory authorities will collect the data they need to support these new powers.

That changed on 22 July, with the publication of EIOPA’s Consultation on draft Implementing Technical Standards (ITS) on resolution reporting - IRRD and the draft IRRD taxonomy and reporting templates with feedback requested by 31 October 2025.

What’s in the consultation?

The consultation sets out the proposed framework for IRRD data collection, including a new set of reporting templates and draft XBRL taxonomy files. Validations have not been published in this draft taxonomy — these are expected in the second public working draft (PWD2) due to be released in the first half of 2026.

The taxonomy has been designed to align with EIOPA’s broader reporting frameworks, reusing existing Solvency II definitions where possible. This should help to reduce duplication and ease the burden for firms.

Reporting frequency is at least once every two years, with ad-hoc information only requested if considered necessary. This is intended to strike a balance between preparedness and reporting burden.

The deadlines for submission have been set as 16 weeks for individual undertakings and 22 weeks for groups, but an extra 4 weeks has been included for the first reporting date (i.e. 20 weeks for individual undertakings and 26 weeks for groups).

What reporting is required?

Below is a summary of the sort of data that needs to be submitted and where it appears in the published templates.

| Report section | Solo | Group | |

|---|---|---|---|

| High-level information on legal entities and ownership structure | IR.02 | ✓ | ✓ |

| Breakdown of liability structure | IR.03 | ✓ | ✓ |

| Intragroup financial interconnections | IR.04 | ✓ | |

| List of major counterparties | IR.05 | ✓ | |

| List of insurance guarantee schemes | IR.06 | ✓ | |

| Breakdown of critical functions and core business lines | IR.07 | ✓ | ✓ |

| Breakdown of services | IR.08 | ✓ | ✓ |

| Details of financial market infrastructure providers and users | IR.09 | ✓ | ✓ |

In the first half of 2026, EIOPA will be publishing validations consistent with those used for Solvency II reporting, which is an indication that IRRD reporting is expected to be fully integrated into firms’ regulatory reporting processes and not handled as an ad-hoc exercise.

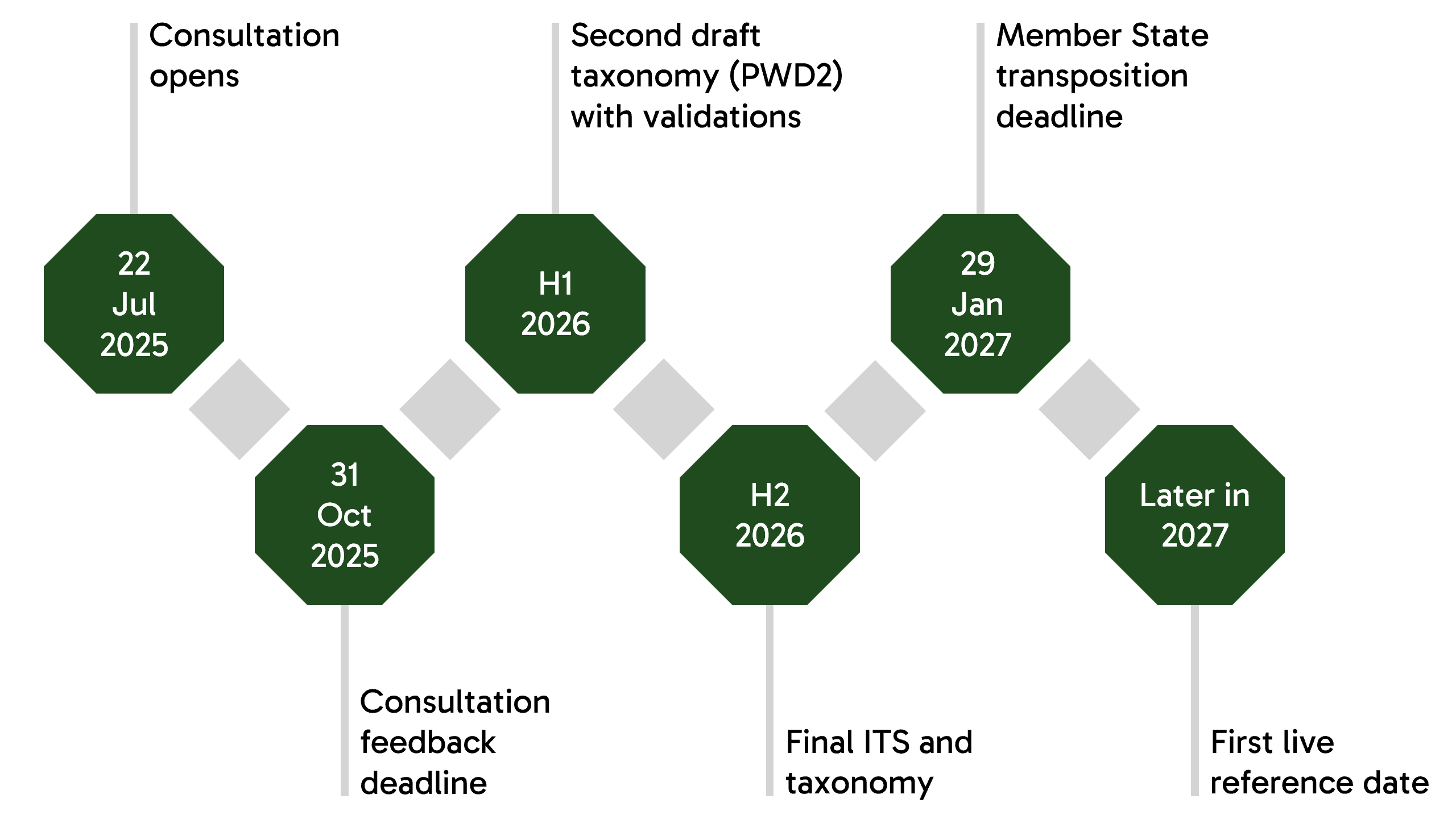

Timeline

| Date | Event |

|---|---|

| 22 July 2025 | Consultation opens |

| 31 October 2025 | Consultation feedback deadline |

| First half of 2026 | Second draft taxonomy (PWD2) with validations |

| Second half of 2026 | Final ITS and taxonomy |

| 29 January 2027 | Member State transposition deadline |

| Later in 2027 | First live reporting reference date |

Next steps

Given the technical nature of the taxonomy and the data involved, early preparation is strongly advised. This is particularly important for groups operating across multiple Member States.

The first reporting reference date can be any time after 30 January 2027. That may feel distant, but in practice it gives firms little over a year to get themselves ready for live reporting.

Understand the requirements

Take a look through the consultation and the reporting templates to understand what you need to get ready for.

Map internal data and update systems

Start talking to your data teams to make sure you can extract the data you need to report.

Find an XBRL provider

In order to make the most of the consultation window and be able to provide valuable feedback to EIOPA, we’d recommend getting an IRRD XBRL software solution and try to get all the way through to an XBRL so you can fully identify any issues early.

Provide feedback to EIOPA

Do take the opportunity to feed back to EIOPA on the consultation. This will likely be the only opportunity to comment on the structure of the templates, with the second draft taxonomy just focussed on validation tests.

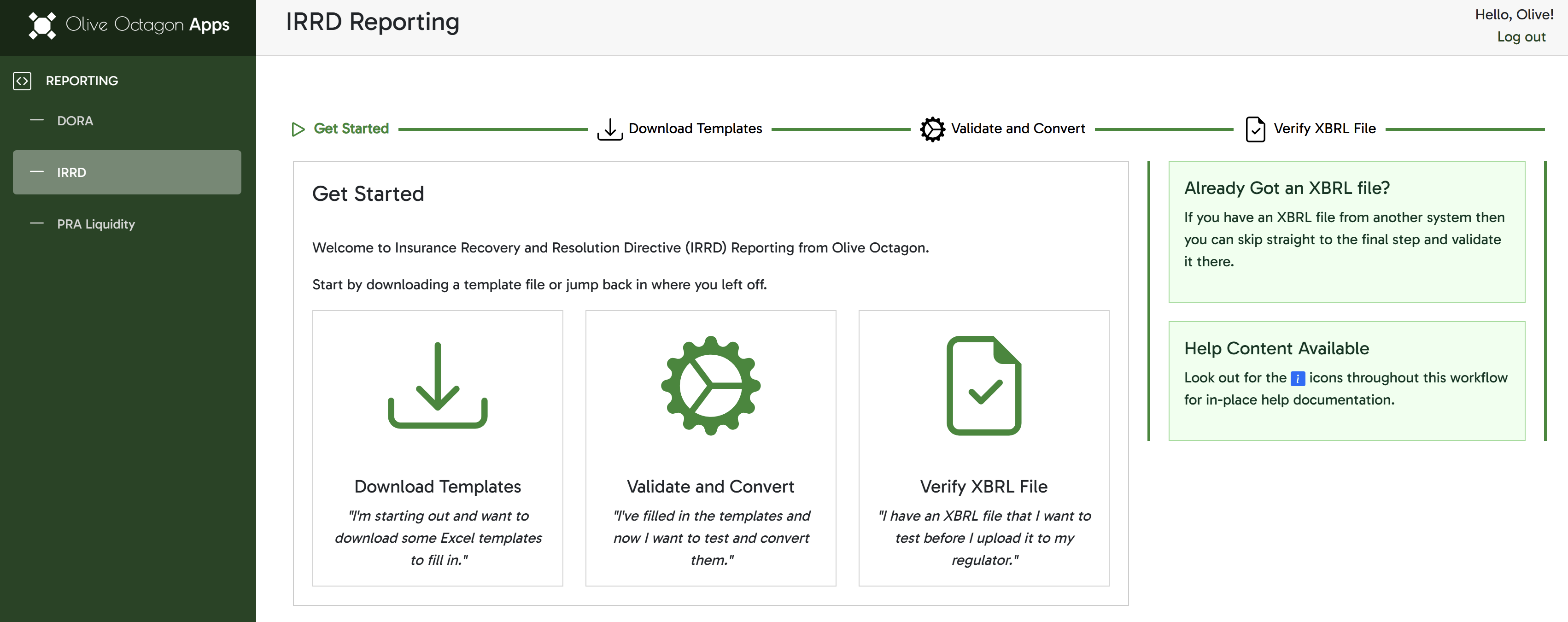

Olive Octagon’s IRRD Reporting Solution (Free until 2027!)

To help insurers meet the upcoming IRRD obligations and to allowing firms to explore the taxonomy and provide feedback to EIOPA, Olive Octagon has developed a dedicated IRRD reporting tool which is free to use until reporting goes live in 2027. It provides:

- Full support for the EIOPA taxonomy and validations*

- Easy-to-use data input using native Microsoft Excel functionality (either by an installed version of Excel or using Excel in the browser if you have a Microsoft 365 subscription)

- Secure, browser-based validation* and XBRL generation where all of your data stays on your computer — nothing is sent to our servers

*Note that the validations for IRRD have not yet been published.

To learn more about our IRRD reporting software, visit the Olive Octagon IRRD XBRL Reporting product page, or contact us using the form below.